Shipowners will face difficult decisions which assets to invest in as for the next 10-15 years the (maritime) transportation transition will be one of sliding panels at different pace. This pace will depend on the speed that the energy and regulatory transition takes place in the different trading regions.

Shipowners, shippers, operators and financiers are all exposed to weighing decisions how to make sure financial commitments are future proof, regulatory compliant and commercially sound. “Doing the right thing” for parties involved may become an interesting balance between long term preference and shorter term reality. Will long term residual risks for NB considerations pay off versus shorter term residual exposure of retrofitted (more) conventional fuel vessels that fall (well) within the regulatory requirements?

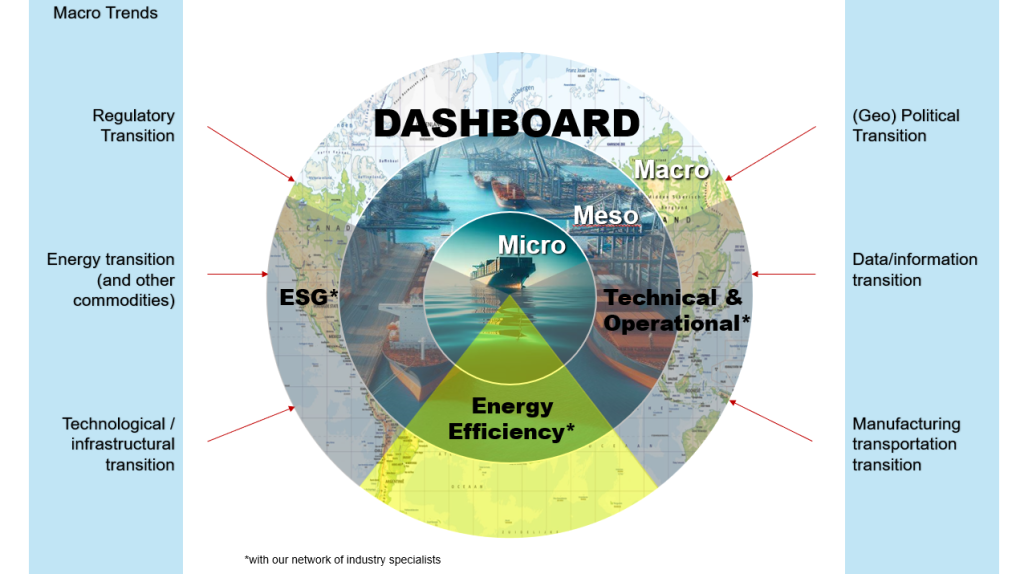

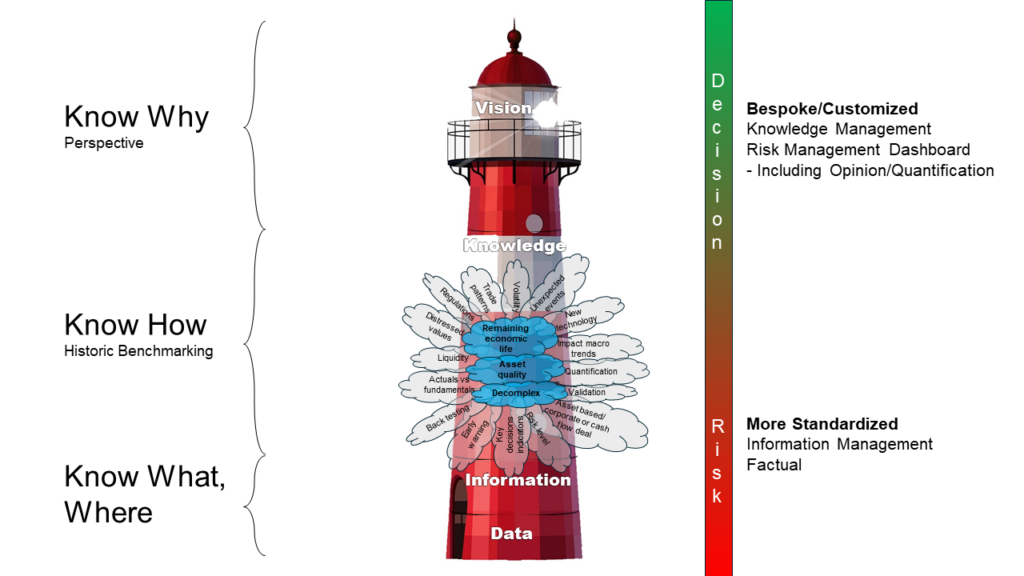

At V@RR we can assist you by combining our corporate support expertise and delivering the top 20% of information essentials required. We use a structured approach that is based on our Strategic Resilience Platform which pillars include ESG, Energy Efficiency and Technical/Operational matters to ultimately result in an information dashboard.